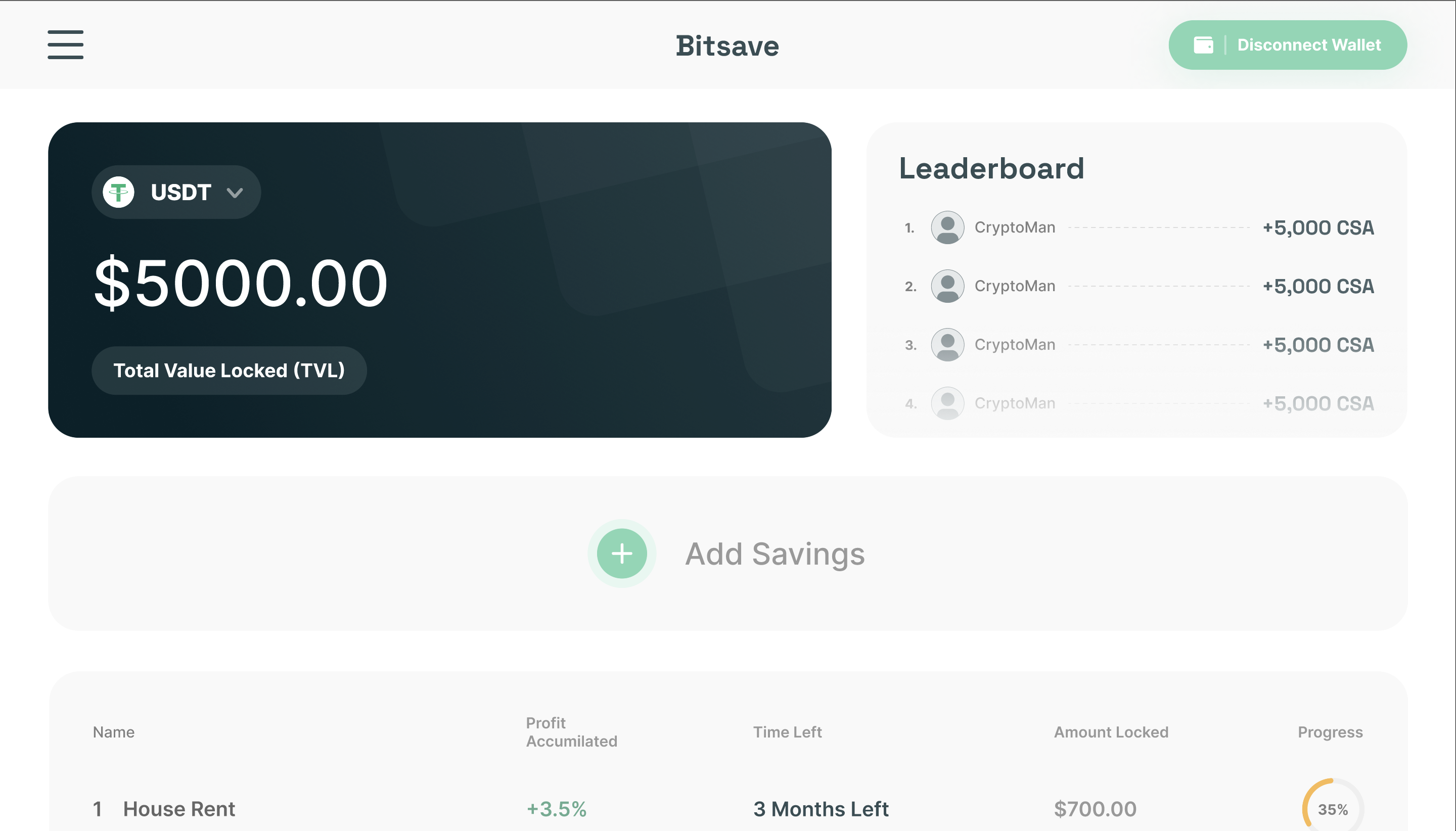

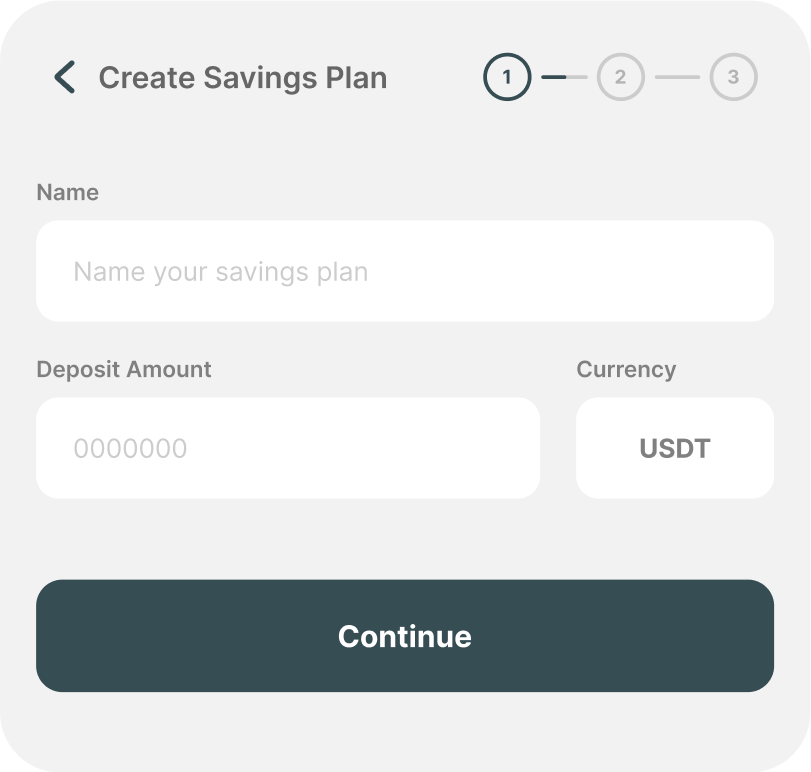

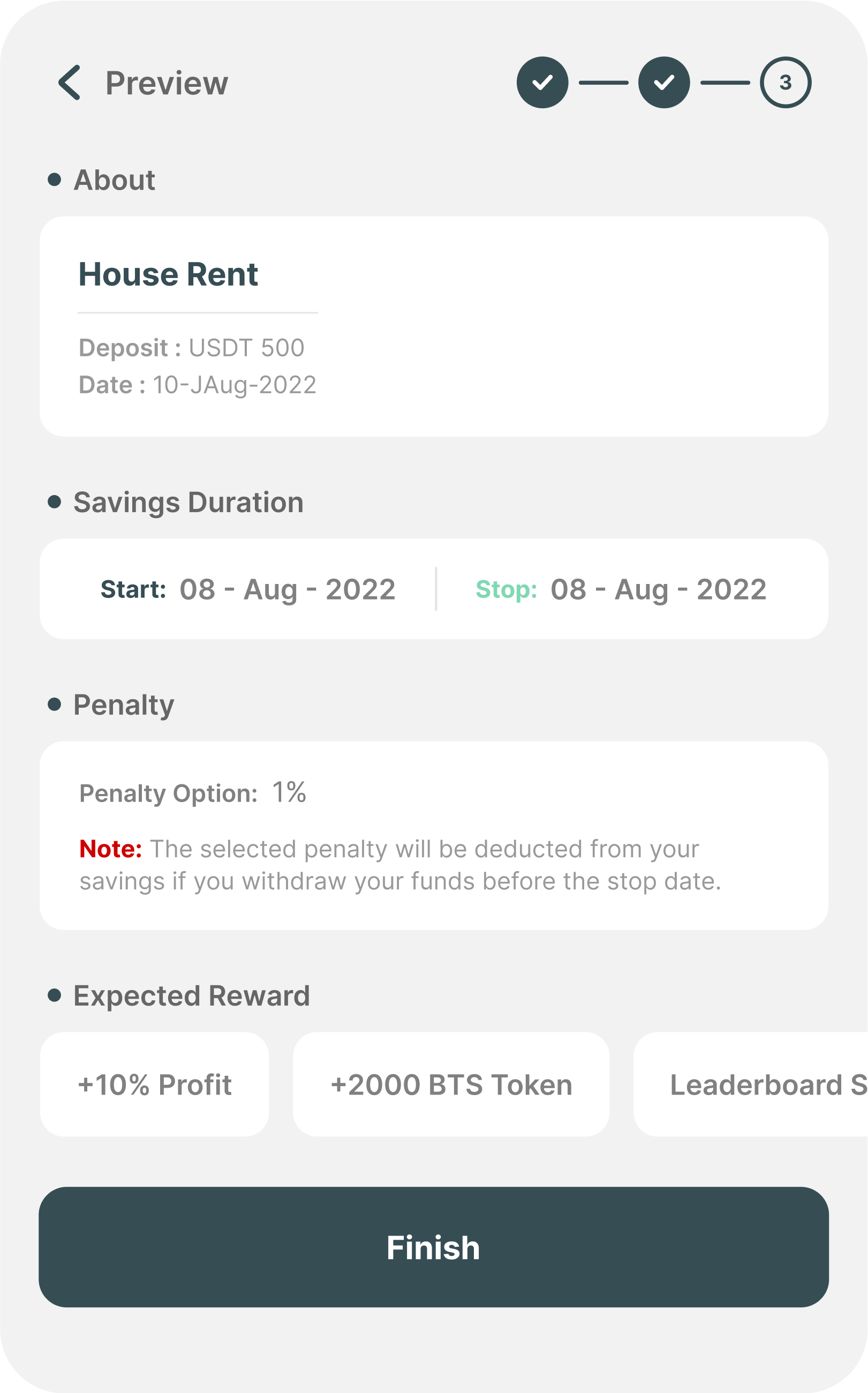

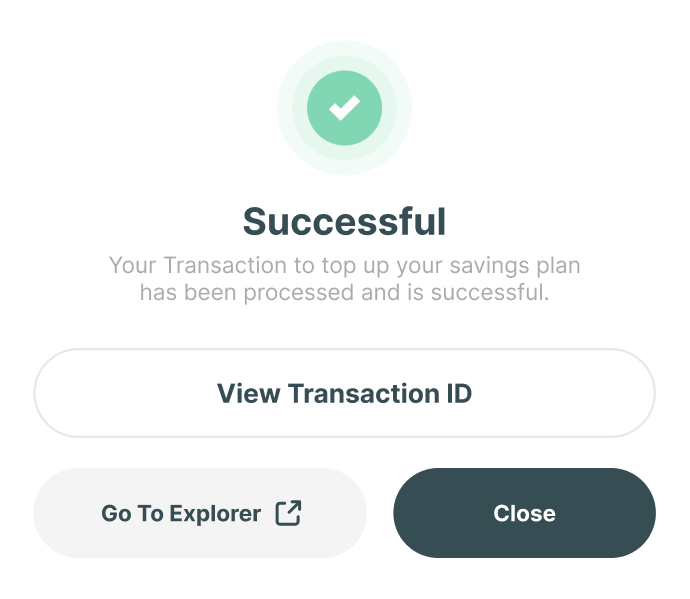

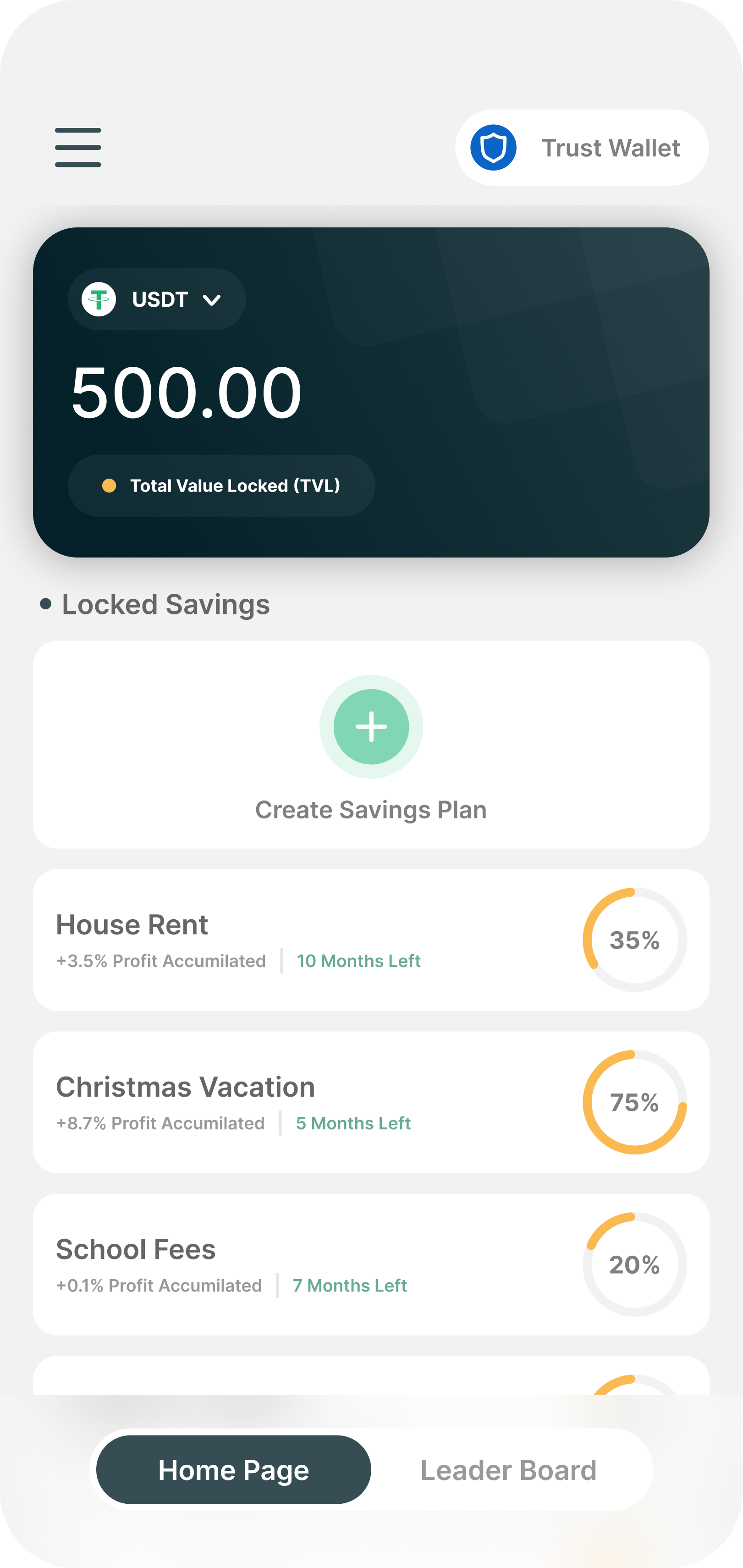

Users create a savings plan and deposit.

Bitsave's savings plan creates a child contract under the parent contract, securing deposits to the user's wallet. Hackers cannot access funds unless they have access to the wallet, unlike DeFi pools.

Users' Interest

Bitsave calculates interest using a formula that combines variables and constants, including its own rate formula. Additionally, the protocol has a buy-back mechanism for its native tokens, ensuring their stability and liquidity.

Users' Savings Plans and Fees

Users are charged a 1-time savings fee on savings plan creation (child contract), every fee is split in a 50:50 ratio, where 1 part goes to a buy-back wallet to buy back the protocol native tokens from any AMM or Dex in the ecosystem.

How It Works

Bitsave isn't just another product, it's a new value chain, The web 3 space is used to DeFi, and now we're introducing them to SaveFi.

Users typically save in a Fiat-Backed stable coin (We don’t want a Terra Situation😕)

Users earn interest in a volatile token, typically the native token of the Bitsave Protocol.

Users can create a savings plan and make unlimited deposits.

Users pay a $1 fee per savings plan they create.

Bitsave Team

Primidac

CTO

Xpan Victor

Lead Developer

Great Adams

Web3 Developer

Onyeka Ekwemozor

Marketing Lead